Fixed Income Fund

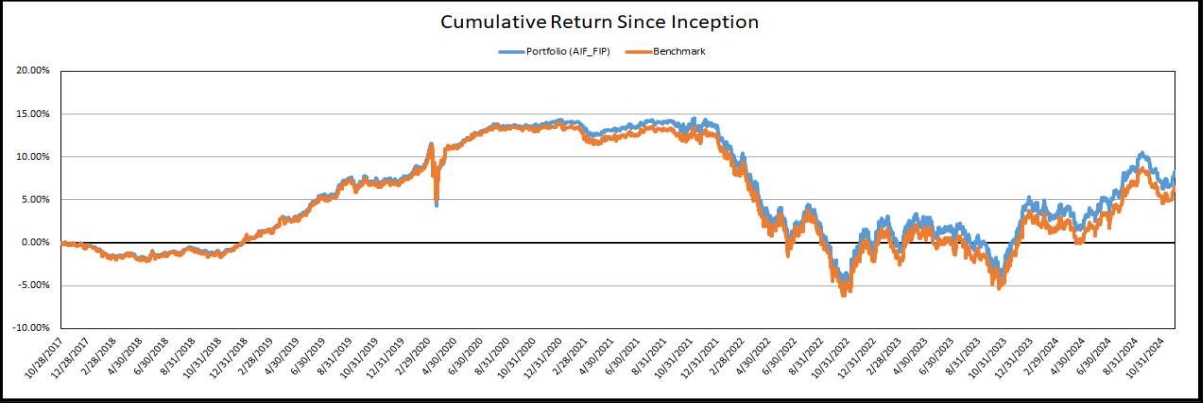

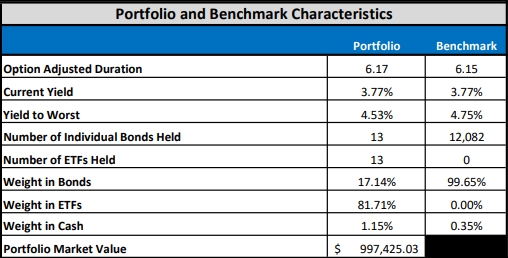

The student-managed Fixed Income Fund provides a hands-on learning experience in which students seek to achieve risk-adjusted returns that equal or exceed the returns on the Fund’s benchmark index. Students involved in the program work in conjunction with Professor Kevin Maloney to maintain a well-diversified portfolio consisting of investment grade fixed income investments, initially valued at $500,000.

LONG-TERM OBJECTIVE AND BENCHMARK

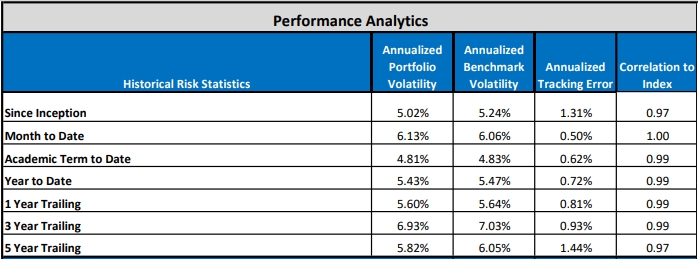

The Fund seeks returns, considering both income and price appreciation, in excess of its Benchmark, the ETF with the ticker symbol AGG, while maintaining a volatility less than 120% of that of its Benchmark. This ETF tracks the Bloomberg Barclays Aggregate Index. That index consists primarily of U.S. Government Treasury and Agency notes and bonds, investment grade corporate bonds issued by U.S. corporations, and Agency Mortgage-Backed Securities. Those three sectors account for approximately 94% of the asset value in the index. Commercial Mortgage Backed Securities, Asset Backed Securities, taxable municipal securities, and US dollar denominated issues of other sovereign and supranational issuers account for the remainder of the assets in that index. The precise characteristics and composition of this index varies through time. Its characteristics and risks can and will be monitored through the Bloomberg terminals available for use by the students in the program. The Benchmark was chosen due to its wide diversification, and its common usage as a benchmark for both active and fixed income portfolios. It is expected that the tracking error of the portfolio versus this benchmark, defined as the

annualized standard deviation of excess returns, will be kept below 2%.

Other fixed income indices may be used from time to time to evaluate performance of portions of the Fund, such as individual fixed income sectors, and used in performance attribution analysis.

TYPES OF SECURITIES

Eligible investments will initially be limited to fixed income ETFs, plus individual U.S. Treasury and Agency notes and bonds. A list of eligible ETFs is attached in the appendix of this document. The ETFs on the eligible investment list must limit their underlying holdings to U.S. dollar denominated fixed income securities. ETFs containing corporate bonds or loans rated below investment grade by either Moody’s or Standard and Poors are eligible, but the total portfolio exposure to non-investment grade bond and loans will be limited to no more than 10% of the portfolio.

OTHER CONSIDERATIONS

Students will gain experience in the following:

- Using Options for Risk Management

- Diversification

- Interest Rate Risk

- Liquidity Considerations

- Trading and Execution

- Monitoring and Reporting

Investment Policy

2025

2024

January 2024 Archway Fixed Income Report (PDF)

February 2024 Archway Fixed Income Report (PDF)

March 2024 Archway Fixed Income Report (PDF)

April 2024 Archway Fixed Income Report (PDF)

May 2024 Archway Fixed Income Report (PDF)

June 2024 Archway Fixed Income Report (PDF)

July 2024 Archway Fixed Income Report (PDF)

August 2024 Archway Fixed Income Report (PDF)

September 2024 Archway Fixed Income Report (PDF)

October 2024 Archway Fixed Income Report (PDF)

November 2024 Archway Fixed Income Report (PDF)

December 2024 Archway Fixed Income Report (PDF)

2023

January 2023 Archway Fixed Income Report (PDF)

February 2023 Archway Fixed Income Report (PDF)

March 2023 Archway Fixed Income Report (PDF)

April 2023 Archway Fixed Income Report (PDF)

May 2023 Archway Fixed Income Report (PDF)

June 2023 Archway Fixed Income Report (PDF)

July 2023 Archway Fixed Income Report (PDF)

August 2023 Archway Fixed Income Report (PDF)

September 2023 Archway Fixed Income Report (PDF)

October 2023 Archway Fixed Income Report (PDF)

2022

January 2022 Archway Fixed Income Report (PDF)

February 2022 Archway Fixed Income Report (PDF)

March 2022 Archway Fixed Income Report (PDF)

April 2022 Archway Fixed Income Report (PDF)

May 2022 Archway Fixed Income Report (PDF)

June 2022 Archway Fixed Income Report (PDF)

July 2022 Archway Fixed Income Report (PDF)

August 2022 Archway Fixed Income Report (PDF)

September 2022 Archway Fixed Income Report (PDF)

October 2022 Archway Fixed Income Report (PDF)

November 2022 Archway Fixed Income Report (PDF)

2021

January 2021 Fixed Income Report (PDF)

February 2021 Fixed Income Report (PDF)

March 2021 Fixed Income Report (PDF)

April 2021 Fixed Income Report (PDF)

May 2021 Fixed Income Report (PDF)

June 2021 Fixed Income Report (PDF)

July 2021 Fixed Income Report (PDF)

August 2021 Fixed Income Report (PDF)

September 2021 Fixed Income Report (PDF)

October 2021 Fixed Income Report (PDF)

November 2021 Fixed Income Report (PDF)

December 2021 Fixed Income Report (PDF)

2020

December 2020 Fixed Income Report (PDF)

November 2020 Fixed Income Report (PDF)

October 2020 Fixed Income Report (PDF)

September 2020 Fixed Income Report (PDF)

August 2020 Fixed Income Report (PDF)

July 2020 Fixed Income Report (PDF)

May 2020 Fixed Income Report (PDF)